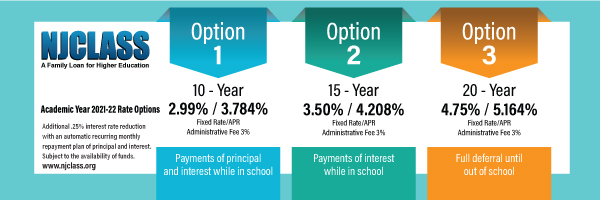

The Higher Education Student Assistance Authority (HESAA) today launched the new interest rates and options for its NJCLASS family loan program for the 2021-22 academic year — which now offer the lowest interest rates in the 30-year history of the program. HESAA's new rates and expanded repayment options are designed to enable New Jersey students to stay on track toward degree completion. Now, more than ever, families need affordable college financing and repayment options. NJCLASS family loans offer significantly lower interest costs than the federal Parent PLUS loan. Families can save even more by opting for an automatic monthly repayment plan of principal and interest to qualify for a 0.25% reduction of their NJCLASS loan interest rate, subject to availability of funds. HESAA also never charges late fees.

"NJCLASS loans offer low-cost financing options to help New Jersey students and families achieve their long-term goal of graduation. The new interest rates we announced today will enable even more students to return to college campuses and classrooms in the fall of 2021," said

David J. Socolow, HESAA's Executive Director. HESAA also announced new, low-cost options to help borrowers save money by refinancing prior student loans at rates as low as 2.99%, through the NJCLASS ReFi+ program. Borrowers can apply for ReFi+ loans to refinance NJCLASS loans, federal Parent PLUS loans, or private educational loans into one convenient monthly payment with 10-year or 15-year repayment plans. Click

here to calculate the cost savings offered by the NJCLASS ReFi+ program. To learn more about New Jersey's grants and scholarship programs, click

here. To learn more about the NJCLASS family loan programs, click

here.

|