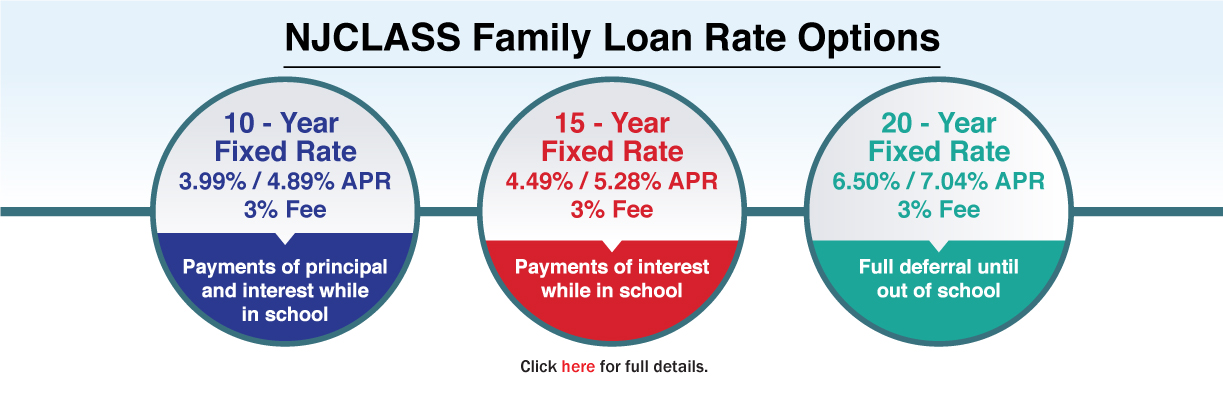

The newly released interest rates reflect HESAA's commitment to providing New Jersey students with competitive financing options

while also providing relief for borrowers struggling to repay student loan debt The Higher Education Student Assistance Authority (HESAA) today launched the new interest rates and options for its NJCLASS family loan program for the 2019-20 academic year. "We are constantly striving to improve access to a postsecondary education and this year's NJCLASS loan options will help reduce the cost of borrowing to pay for college," said David J. Socolow, HESAA's Executive Director. "The interest rates for NJCLASS loans in Academic Year 19-20 are more affordable than either the federal Parent PLUS loans or private loans. Our goal is to help New Jersey students and families achieve their long-term goal of graduation to build a successful future," said Socolow.

NJCLASS borrowers are required to first exhaust all other financial aid options, including federal, state, and institutional grants and scholarships. Students must also first borrow the maximum federal direct loans (subsidized and non-subsidized) before applying for a supplemental NJCLASS family loan. NJCLASS loans can enable access to higher education for families with remaining unmet need after applying all these other financial resources to their college costs. The NJCLASS family loan is often compared to the federal Parent PLUS loan. For Academic Year 2019-20, the NJCLASS interest rates are again lower than the Parent PLUS loan rate of 7.08%. In addition, the NJCLASS family loan amount must be certified by the college or university and the student must be achieving satisfactory academic progress. For borrowers who are no longer in school and are in a position to pay down their loans faster, HESAA offers the ReFi+ loan, a refinancing option for NJCLASS and/or Parent PLUS loans. Currently, ReFi+ offers a 10-year, fixed-rate refinance loan. For borrowers wishing to refinance student loans over a longer term and with lower monthly payments, HESAA will introduce a new, 15-year, fixed-rate ReFi+ option later this year. For a preview, click

here. For new NJCLASS loans originated for the 2019-2020 academic year, borrowers who opt-in for automatic recurring monthly payments may receive a 0.25 percent interest rate reduction, subject to availability*. This 0.25 percent interest rate reduction is available to borrowers whose eligible loans are in a monthly repayment of principal and interest status. Over the past year, HESAA successfully partnered with the Governor and the Legislature to enact reforms that help NJCLASS borrowers who are struggling with repayment. P.L 2019, c. 62, signed into law by Governor Murphy on April 25, 2019, makes the Repayment Assistance Program (RAP) and the Household Income Assistance Repayment Plan (HIARP) permanent features of NJCLASS going forward, building on the initial creation of these alternate payment options as part of the past two annual bonds that finance the NJCLASS program. On the same day, the Governor signed P.L. 2019, c. 63, which codifies HESAA's revised procedures for affordable installment agreements for borrowers and co-signers to repay defaulted NJCLASS loans, and enables HESAA to repair the credit ratings of borrowers who consistently comply with such payment plans. To learn more about New Jersey’s grants and scholarship programs, click

here. To learn more about the NJCLASS family loan program, click

here.

|